Providing specialized insurance programs to municipalities, public administration and community service organizations across Canada.

About the Program

With over five decades of experience in providing a specialized and industry leading insurance programs, Western Financial Group Insurance Solutions works in partnership with the Association of Manitoba Municipalities to administer the AMM General Insurance Program.

Advantages

LONG-TERM RATE STABILITY

Stability is generated by spreading claims over the entire pool of program participants

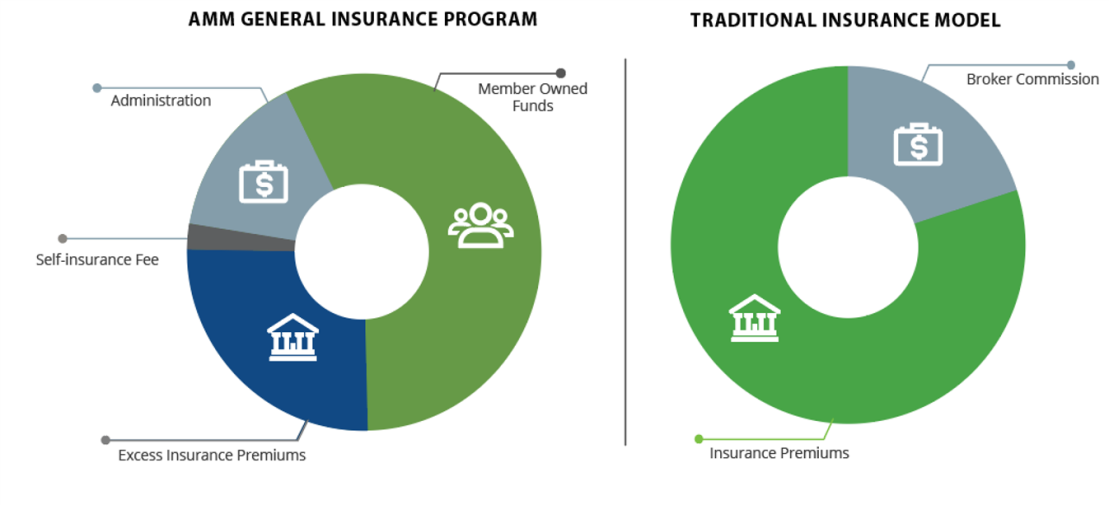

COST SAVINGS

Members receive an immediate savings off existing premiums for equivalent coverage

PROGRAM FLEXIBILITY

Member organizations have many different coverage options to choose from