Essential Insurance Coverage for Ontario Motorcyclists

Having the right insurance coverage is a must for motorcyclists in Ontario.

Just like car insurance, motorcycle insurance coverage is legally required for Ontario motorcyclists and for all motorcyclists in Canada.

Here’s what you need to know about both mandatory and useful insurance coverage options that motorcycle owners need to navigate the roads of Ontario safely and responsibly.

In Ontario, all motor vehicles, including motorcycles, must be insured for third-party liability.

This coverage protects you if you are at fault for injuring someone else or damaging their property in an accident involving your motorcycle. The minimum required liability coverage for motorcycles in Ontario is $200,000, but it's recommended to opt for higher limits to ensure adequate protection in case of a serious accident. To legally ride a motorcycle in Ontario, you must also have a valid M1, M2, or M class license and be at least 16 years of age.

Accident benefits coverage

Accident benefits coverage is mandatory and it provides compensation for medical expenses, rehabilitation costs, and lost income if you are injured in a motorcycle accident, regardless of who is at fault.

This coverage also includes benefits for funeral expenses and death benefits in the event of a fatal accident. It's important to review your accident benefits coverage to understand the extent of protection it offers and consider increasing your coverage limits if needed.

Uninsured automobile overage

Also legally required, uninsured automobile coverage protects you if you're involved in an accident with an uninsured or unidentified driver and they are at fault. This coverage ensures that you're still covered for medical expenses, rehabilitation, and other accident benefits in such situations. Considering the potential risks on the road, having uninsured automobile coverage provides an added layer of security for motorcycle riders.

Optional Coverages

While not mandatory, collision and comprehensive coverage are highly recommended for motorcycle owners in Ontario.

Collision coverage protects you against damage to your motorcycle resulting from a collision with another vehicle or object, regardless of fault.

Comprehensive coverage, on the other hand, covers damage to your motorcycle caused by events such as theft, vandalism, fire, or natural disasters.

Enhanced coverage: optional endorsements

In addition to standard insurance coverage, there are optional insurance coverages that motorcycle owners can consider to enhance their protection further.

For example, adding coverage for custom parts and equipment ensures that any aftermarket upgrades or accessories installed on your motorcycle are covered in the event of damage or theft.

Roadside assistance coverage is another valuable endorsement that provides peace of mind by offering assistance with towing, fuel delivery, and other roadside services.

See the chart below to better understand mandatory and additional motorcycle insurance options in Ontario:

How much does motorcycle insurance cost in Ontario?

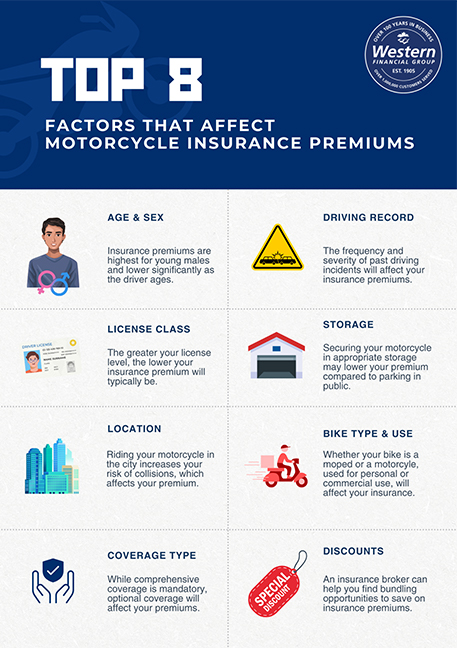

Various factors can affect the cost of your recreational vehicle insurance premiums, including your age, driving history, type of motorcycle, engine size, and even your residential area.

For instance, insuring a high-powered sport motorcycle tends to be more expensive compared to a traditional road bike due to the perceived higher risk associated with such vehicles.

Usually, the cost of your insurance can also vary depending on how much of a deductible you’re willing to accept.

A quick refresher - What is a deductible?

A deductible is the minimum amount you’ll need to pay out of pocket in case of a claim before insurance will apply to the rest of the covered damages. The higher the deductible you can feasibly handle, the lower your monthly charges tend to be. A Western Financial Group insurance expert can help you make sense of deductibles and monthly or annual rates, along with other personal factors, to help you find the right fit for motorcycle insurance in Ontario.

Discounts and savings opportunities

Discounts can vary depending on factors such as your driving record, the type of motorcycle you ride, and whether you've completed a motorcycle safety course. An insurance broker can help you compare the best available rates from across Ontario to find the perfect match for your situation.

Having the right insurance coverage is essential for motorcycle owners in Ontario to protect themselves, their passengers, and their assets in the event of an accident or unforeseen circumstances.

By understanding the mandatory and optional insurance requirements, Ontario motorcyclists can be confident they have the right protection while enjoying the freedom of the open road.

Just like car insurance, motorcycle insurance coverage is legally required for Ontario motorcyclists and for all motorcyclists in Canada. Whether you’re comparing motorcycle policies or searching for the best car insurance Ontario drivers rely on, understanding provincial insurance requirements is key to staying protected on the road.